This post is the second installment of the U.S. Economy and Commercial Real Estate Markets series presented by Mark Cypert at the Encore Wealth Breakfast on 12.12.12.

Last week I reviewed the fiscal cliff and discussed what the U.S. economy would look in the coming year like given a variety of possible scenarios. Today I will look at consumer confidence, the second part of the equation when determining economic outlook. My third and final installment, on understanding unemployment, will follow.

Loosely defined, consumer confidence represents how buyers feel about the current and future state of the economy. Because consumer confidence impacts consumer expenditures, which account for approximately 70% of total U.S. economic output as measured by GDP, a high amount of consumer confidence represents a positive relationship with economic growth. While growth may be occurring at a promising and steady rate, the large drop in consumer confidence that occurred during the recession makes the climb back up to “normal” levels a slow and steady one. Though consumer sentiment has trended upward since 2009, it remains below pre-recession levels due to a combination of high unemployment rate, a housing bust, the financial crisis, and continued fiscal uncertainty.

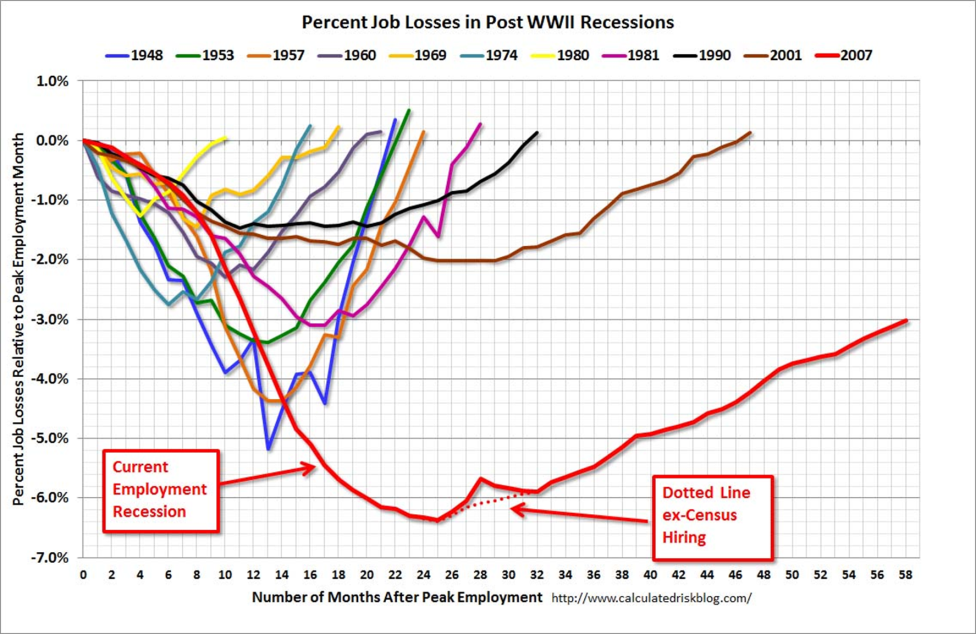

Unemployment

According to the U.S. Bureau of Labor Statistics, October 2012 saw 5 million workers be unemployed for 26 weeks or more. Though this is generally trending downwards, the number of unemployed people remains very high. As an integral component to consumer confidence, unemployment rates must be reduced in a drastic manner to boost confidence. (This discussion on unemployment is by no means exhaustive, and will be analyzed in greater detail in the following blog post.)

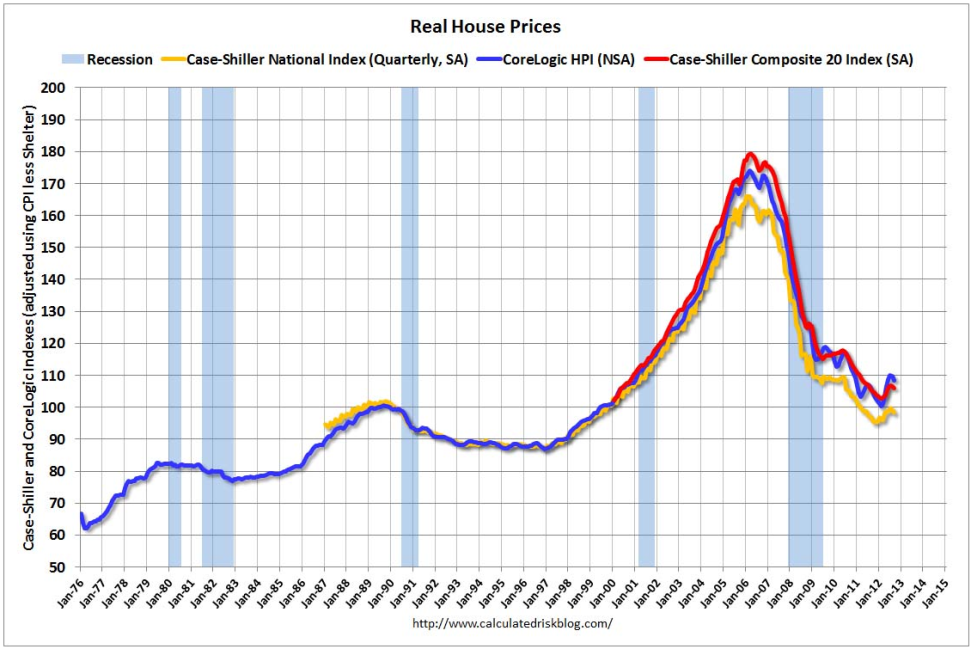

Housing Market

U.S. home prices, another substantial piece of the consumer confidence puzzle, tell a similar story. Currently, U.S. home prices are 30.9% below their peak 2007 values and, adjusting for inflation, home values have reverted back to the levels of 1999-2001. While this too may seem as a relatively bleak depiction of the housing market, it is important to remember that these indicators are trending in a positive direction in light of the damage done by the great recession.

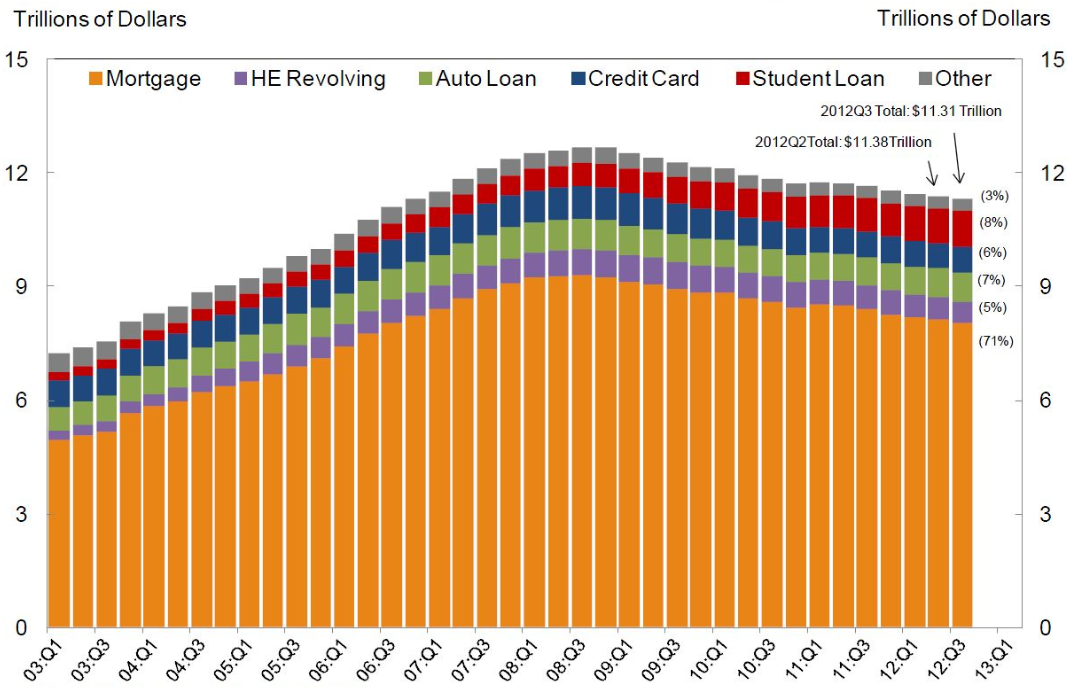

Consumer Debt

Image from calculatedriskblog.com

Consumer debt has continued to trend downward since mid-2008 but student loan debt has continued to increase. Despite the growing student debt, the overall consumer debt is trending downwards. This downward trend represents a positive indicator for overall consumer confidence.

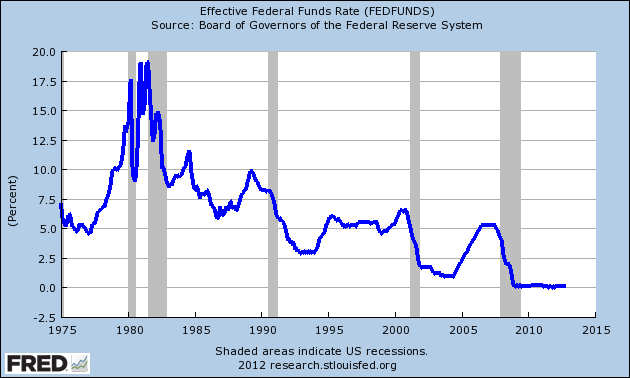

Monetary Policy

The U.S. Federal Reserve monetary policy has also had a significant impact upon total economic output. While the Federal Reserve does hold the tools to manipulate the U.S. economy the fastest and in the most direct manner, their ultimate goal remains to provide economic stimulus but not so much that high inflation becomes a problem. Due to the monetary policy, inflation is currently running near its 2% target growth. The Federal Reserve both has indicated that they intend to keep the target range for the federal funds rate, the interest rate at which banks lend their excess balances to other banks overnight, at 0 to 0.25% through at least mid-2015. It is important to note that this has been set to historically low rate to spur economic growth, and will likely never remain at such a level. While commercial banks do continue to deal with problem loans, the overall commercial lending to fuel business growth continues to trend upward.

Conclusion

Given the above mentioned economic indicators, it is abundantly clear that consumer expenditures, subdued inflation, historically low interest rates and a recovering lending environment have all contributed to the growth of consumer confidence as well as a 2% growth (adjusted for inflation) of the U.S. economy as a whole. If the Fed is keeping rates historically low to stimulate continued economic growth and the supply of capital to find business expansion continues to increase, businesses will continue to witness a drastic increase in corporate profits. Though corporate profits started to rebound midway through the previous recession due to expense cutting, revenue growth has allowed for a rapid increase in corporate profits to record high levels. Over time, profitable business owners tend to expand their workforce if they are confident that prospects for revenue growth can be sustained.

Mark Cypert serves as president of Encore Office. He is a senior lecturer for the CCIM Institute with his specialty being in commercial real estate market analysis. For his full biography, click here.