Earlier this week we reviewed vital portions of the American Taxpayer Relief Act of 2012. As a continuation to the prior post, this week we will review the new taxes that took effect January 1st 2013 under the Patient Protection and Affordable Care Act, otherwise known as Obamacare. To view the first installment, please click here.

Surtax on Investment Income

High income earners, meaning those earning over $200,000 filing as single or $200,000 for married couples filing jointly, can now be expected to see a 3.8% Medicare surtax on their investment incomes. This new law applies to all forms of investment income, including interest, capital gains, and dividends so long as they are above the $200,000 threshold. This tax is expected to bring $123 billion in revenue.

Higher Medicare Payroll Taxes

Individuals earning over the $200,000 threshold and filing as single or $250,000 and filing as married will see a raise in their Medicare payroll tax of 0.9%. This is an increase from the prior years’ 1.45%. This is expected to raise $86.6 billion.

Medical Device Tax

Affecting a relatively small group of the population, the medical device tax will impact approximately 360,000 people who are currently employed in the medical manufacturing industry. The new law places a 2.3% excise tax on medical devices that retail over $100. This new tax has come under great scrutiny, as it is imposed on the sale of items as opposed to the profit garnered from the sale of these items. As a result, many medical device manufacturing companies will be forced to raise prices – decreasing the facility to engage in technical innovation. The medical device tax is excepted to raise $20 billion in revenue.

Limits on Itemized Medical Expense Deductions

Generating $15.2 billion in revenue, the Patient Protection and Affordable Care Act modifies the previous limits on itemized medical expense deductions from the original 7.5% to a new high of 10% of adjusted gross income. While this 10% will be the going rate for all Americans regardless of what tax bracket they may find themselves in, seniors 65+ will be eligible to use the old 7.5% rate for the next three years.

Flexible Spending Account Limits

Starting January 1st 2013 flexible spending accounts (FSA) and similar pre-tax accounts will no longer be welcoming unlimited contributions, rather they will henceforth be capped at $2,500 annually. Much controversy has surrounded this new law, as many families with special needs children use said FSAs to pay for tuition and special needs childcare related expenses. Despite such unabashed criticisms, the law is expected to garner $13 billion in revenue and will only affect a small minority of FSA users, as many employers have already independently chosen to cap FSA allowances prior to the passage of the law.

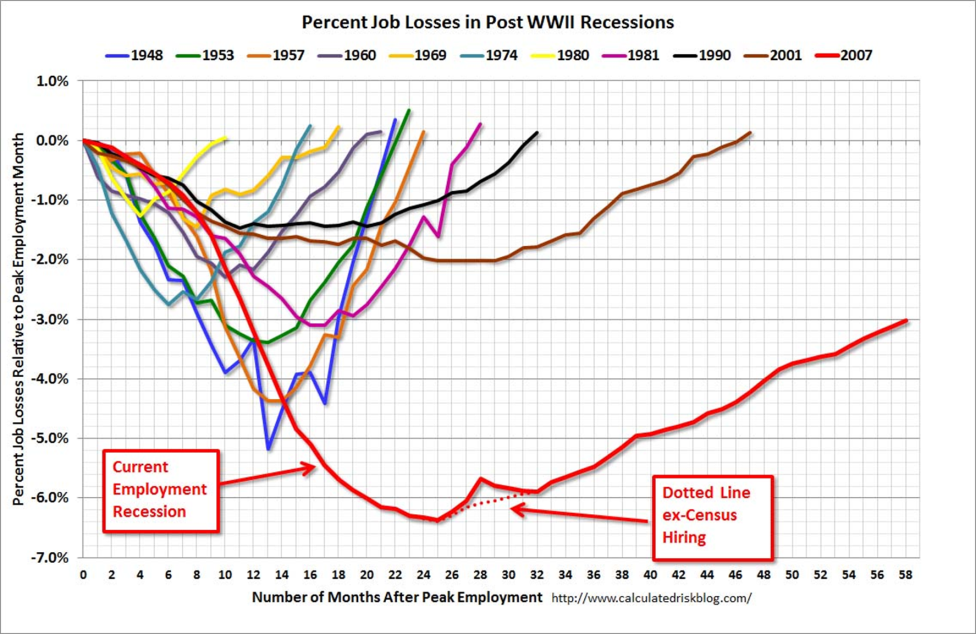

According to the U.S. Bureau of Labor Statistics, October 2012 saw 5 million workers be unemployed for 26 weeks or more. Though this is generally trending downwards, the number of unemployed people remains very high. As an integral component to consumer confidence, unemployment rates must be reduced in a drastic manner to boost confidence. (This discussion on unemployment is by no means exhaustive, and will be analyzed in greater detail in the following blog post.)

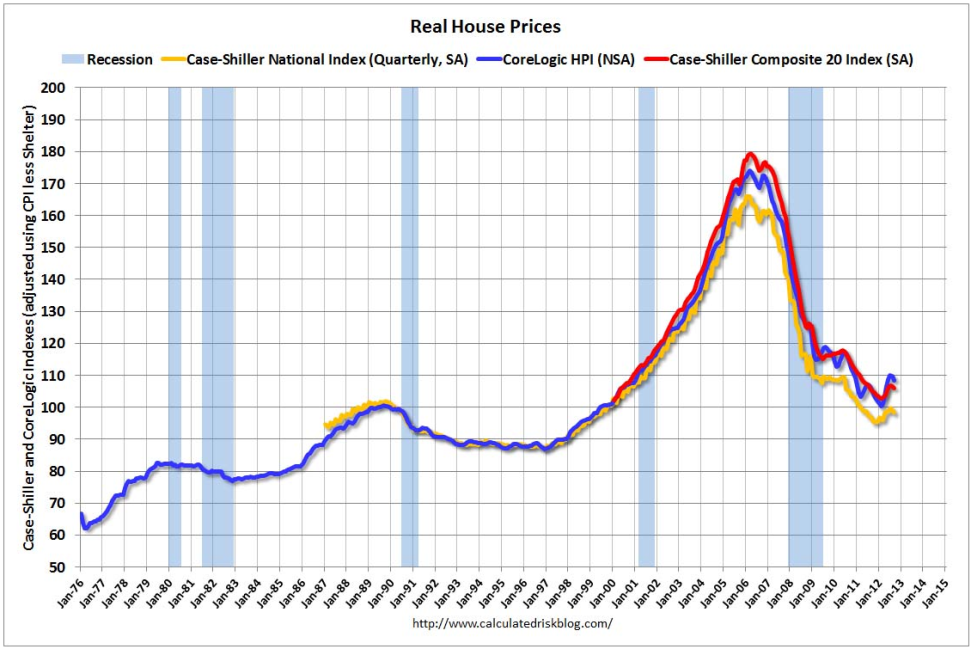

According to the U.S. Bureau of Labor Statistics, October 2012 saw 5 million workers be unemployed for 26 weeks or more. Though this is generally trending downwards, the number of unemployed people remains very high. As an integral component to consumer confidence, unemployment rates must be reduced in a drastic manner to boost confidence. (This discussion on unemployment is by no means exhaustive, and will be analyzed in greater detail in the following blog post.) U.S. home prices, another substantial piece of the consumer confidence puzzle, tell a similar story. Currently, U.S. home prices are 30.9% below their peak 2007 values and, adjusting for inflation, home values have reverted back to the levels of 1999-2001. While this too may seem as a relatively bleak depiction of the housing market, it is important to remember that these indicators are trending in a positive direction in light of the damage done by the great recession.

U.S. home prices, another substantial piece of the consumer confidence puzzle, tell a similar story. Currently, U.S. home prices are 30.9% below their peak 2007 values and, adjusting for inflation, home values have reverted back to the levels of 1999-2001. While this too may seem as a relatively bleak depiction of the housing market, it is important to remember that these indicators are trending in a positive direction in light of the damage done by the great recession.

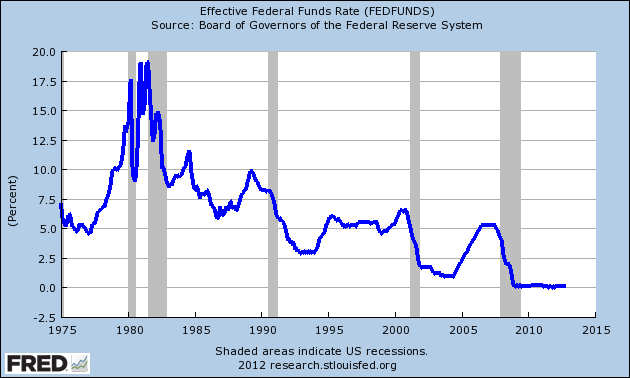

The U.S. Federal Reserve monetary policy has also had a significant impact upon total economic output. While the Federal Reserve does hold the tools to manipulate the U.S. economy the fastest and in the most direct manner, their ultimate goal remains to provide economic stimulus but not so much that high inflation becomes a problem. Due to the monetary policy, inflation is currently running near its 2% target growth. The Federal Reserve both has indicated that they intend to keep the target range for the federal funds rate, the interest rate at which banks lend their excess balances to other banks overnight, at 0 to 0.25% through at least mid-2015. It is important to note that this has been set to historically low rate to spur economic growth, and will likely never remain at such a level. While commercial banks do continue to deal with problem loans, the overall commercial lending to fuel business growth continues to trend upward.

The U.S. Federal Reserve monetary policy has also had a significant impact upon total economic output. While the Federal Reserve does hold the tools to manipulate the U.S. economy the fastest and in the most direct manner, their ultimate goal remains to provide economic stimulus but not so much that high inflation becomes a problem. Due to the monetary policy, inflation is currently running near its 2% target growth. The Federal Reserve both has indicated that they intend to keep the target range for the federal funds rate, the interest rate at which banks lend their excess balances to other banks overnight, at 0 to 0.25% through at least mid-2015. It is important to note that this has been set to historically low rate to spur economic growth, and will likely never remain at such a level. While commercial banks do continue to deal with problem loans, the overall commercial lending to fuel business growth continues to trend upward.