US India Chamber of Commerce honoring Mr. A. K. Mago was held in Dallas on June 20, 2014.

Guests of the Chamber’s Chairman Elect and Encore’s CFO, Mahesh Shetty, were Dr. Narinder and Chander Monga with Encore Director, Brenda Grogan.

US India Chamber of Commerce honoring Mr. A. K. Mago was held in Dallas on June 20, 2014.

Guests of the Chamber’s Chairman Elect and Encore’s CFO, Mahesh Shetty, were Dr. Narinder and Chander Monga with Encore Director, Brenda Grogan.

(Dallas, Texas) Oct. 17, 2013 | PRNewswire – Encore Global Investment Management, LLC (Encore Global), a division of the Dallas-based Encore Enterprises, Inc., plans to develop and/or finance multiple real estate projects in the state of Mississippi as part of its nationwide EB-5 Regional Center network.

The EB-5 Employment-Creation Immigrant Visa Category was created by the United States Citizenship and Immigration Service (USCIS) in 1990 to provide accredited foreign individuals with an opportunity to achieve conditional and permanent resident status by investing lawfully acquired funds (at least $500,000 within a rural area or one of high unemployment, or $1 million anywhere else) in a regional center approved by USCIS. To qualify, each investor must directly or indirectly, through the regional center, create ten full-time jobs in the United States. In exchange for this investment, the investor may be able to obtain an EB-5 Visa, providing permanent residency status for the investor, his or her spouse, and unmarried children under 21 years of age.

The Encore Mississippi Regional Center has been organized to attract foreign capital through the EB-5 program, with the intention of developing multiple new commercial enterprises and job-creating entities located throughout Mississippi. Encore Global will develop and/or fund commercial real estate projects in fourteen Mississippi counties, including the gulf coast area (4 counties), the Hattiesburg area (5 counties), and the Jackson area (5 counties).

“Our EB-5 program provides a low cost-of-capital funding alternative to a wide variety of commercial real estate projects,” said Bharat Sangani, Chairman of Encore Enterprises. “Our EB-5 funding can be in the form of debt or equity. Developers have discovered that this is a very cost effective way to raise capital for real estate projects that create jobs.”

About Encore Global Investment Management, LLC

Encore Global Investment Management, LLC was created to provide an EB-5 investment vehicle for accredited foreign nationals seeking to obtain permanent residency status in the United States. Encore Global owns and operates six USCIS approved Regional Centers across the U.S., and focuses on developing and/or funding commercial real estate projects related to retail, hospitality, multi-family, office, healthcare, and entertainment and recreational facilities. Visit Encore EB5 or call (214) 259-7021 for more information.

Disclaimer: Not every investment is safe, not every investment in a regional center will ultimately result in green card status, and not every investment will produce a profit.

Contact: Amy Upton

Marketing

Encore Enterprises, Inc.

(T) 214-259-2400

aupton@encore.bz

encorebz.wp.brainvire.dev

On Wednesday, May 15th Mark Wischmeyer spoke to a packed crowd on U.S. Health Care reform. View the full presentation below.

<!– Original (dead) embed links:

–>

Earlier this week we reviewed vital portions of the American Taxpayer Relief Act of 2012. As a continuation to the prior post, this week we will review the new taxes that took effect January 1st 2013 under the Patient Protection and Affordable Care Act, otherwise known as Obamacare. To view the first installment, please click here.

Surtax on Investment Income

High income earners, meaning those earning over $200,000 filing as single or $200,000 for married couples filing jointly, can now be expected to see a 3.8% Medicare surtax on their investment incomes. This new law applies to all forms of investment income, including interest, capital gains, and dividends so long as they are above the $200,000 threshold. This tax is expected to bring $123 billion in revenue.

Higher Medicare Payroll Taxes

Individuals earning over the $200,000 threshold and filing as single or $250,000 and filing as married will see a raise in their Medicare payroll tax of 0.9%. This is an increase from the prior years’ 1.45%. This is expected to raise $86.6 billion.

Medical Device Tax

Affecting a relatively small group of the population, the medical device tax will impact approximately 360,000 people who are currently employed in the medical manufacturing industry. The new law places a 2.3% excise tax on medical devices that retail over $100. This new tax has come under great scrutiny, as it is imposed on the sale of items as opposed to the profit garnered from the sale of these items. As a result, many medical device manufacturing companies will be forced to raise prices – decreasing the facility to engage in technical innovation. The medical device tax is excepted to raise $20 billion in revenue.

Limits on Itemized Medical Expense Deductions

Generating $15.2 billion in revenue, the Patient Protection and Affordable Care Act modifies the previous limits on itemized medical expense deductions from the original 7.5% to a new high of 10% of adjusted gross income. While this 10% will be the going rate for all Americans regardless of what tax bracket they may find themselves in, seniors 65+ will be eligible to use the old 7.5% rate for the next three years.

Flexible Spending Account Limits

Starting January 1st 2013 flexible spending accounts (FSA) and similar pre-tax accounts will no longer be welcoming unlimited contributions, rather they will henceforth be capped at $2,500 annually. Much controversy has surrounded this new law, as many families with special needs children use said FSAs to pay for tuition and special needs childcare related expenses. Despite such unabashed criticisms, the law is expected to garner $13 billion in revenue and will only affect a small minority of FSA users, as many employers have already independently chosen to cap FSA allowances prior to the passage of the law.

Narrowly missing their midnight deadline, the Congress averted the impending “fiscal cliff” through passage of the American Taxpayer Relief Act of 2012 with a vote of 89-8 in the Senate, and 257-167 in the House. The president then signed the bill into law on January 2, 2013. Now that the fiscal cliff crisis has been averted, it is essential to review the changes that are to come with the passage of the American Taxpayer Relief Act, as well as the new provisions of the Patient Protection and Affordable Care Act, henceforth referred to as Obamacare, that will take effect January 1st 2013.

American Taxpayer Relief Act of 2012

Marginal Rates

Effective January 1st 2013, the American Taxpayer Relief Act modifies the Bush era tax cuts by implementing sunsets for individuals with incomes above $400,000 for single individuals and $450,000 for families. Individuals earning above the $400,000 mark will see a tax increase of 4.6%, from the previous 35%. For all other individuals in lower tax brackets, marginal rates will stay the same as they were during the Bush era tax cuts.

Capital Gains and Dividends

For capital gains and dividends, the same threshold as described above will be used. The rate for individuals earning over $400,000 will increase to 20% – a 5% increase from the year prior. All other tax brackets will remain at 15%. Joint filers earning below $72,500 and single filers earning less than $36,250 will be taxed at 0%.

Estate Taxes

Both estate and gift taxes have raised to 40% with the exemption being set at $5 million adjusted for inflation. This is a 5% increase from prior years.

Alternative Minimum Tax

Changes to the Alternative Minimum Tax (AMT) include increases to exemption amounts, an allowance of nonrefundable personal credits to the full amount of the person’s regular tax and AMT, and a yearly adjustment for inflation.

Personal Exemption Phase-Outs and Pease

Personal Exemption Phase-Outs, which were suspended under the Bush tax cuts, have been revived albeit at higher levels than in the past. Pease has also been reinstated also with a higher applicable threshold. All dollar amount thresholds required for both PEP and Pease will now be adjusted for tax years following 2013.

Education

One of the Obama Administration’s centerpieces, the American Opportunity Tax Credit (AOTC) has been extended to 2017. The credit provides up to a $2,500 tuition reimbursement for qualifying students. The credit was also modified so that students would be eligible for the credit for a total of four years, as opposed to the prior instated two year maximum. Mutually exclusive with the AOTC, the act extends above-the-line deductions for qualified tuition and related educational expenses.

Mortgage Debt Relief

To give homeowners struggling to make payments relief, the Mortgage Debt Relief Act of 2007 was extended so that homeowners may exclude canceled debt from being taxed on their principal residence up to $2 million.

Business Extenders

A variety of business extenders were included in the Taxpayer Relief Act including extension of the Work Opportunity Tax Credit (WOTC). The WOTC provides a credit for businesses that employ individuals who may be considered targeted groups as per the Federal Government. Such businesses will be provided a credit of up to 40% of the individual’s yearly wages for a maximum of $6,000. To the surprise of many, the research tax credit was also extended with bi-partisan support. Criticized for its annual $1.43 billion cost, the act rewards businesses that choose to invest in qualified research opportunities.

Part two of this segment, which is to be released in the following days, will include a review of the new Obamcare taxes that are to be implemented starting January 1st 2013. You will be able to access the new post here.

Last week I reviewed the fiscal cliff and discussed what the U.S. economy would look in the coming year like given a variety of possible scenarios. Today I will look at consumer confidence, the second part of the equation when determining economic outlook. My third and final installment, on understanding unemployment, will follow.

Loosely defined, consumer confidence represents how buyers feel about the current and future state of the economy. Because consumer confidence impacts consumer expenditures, which account for approximately 70% of total U.S. economic output as measured by GDP, a high amount of consumer confidence represents a positive relationship with economic growth. While growth may be occurring at a promising and steady rate, the large drop in consumer confidence that occurred during the recession makes the climb back up to “normal” levels a slow and steady one. Though consumer sentiment has trended upward since 2009, it remains below pre-recession levels due to a combination of high unemployment rate, a housing bust, the financial crisis, and continued fiscal uncertainty.

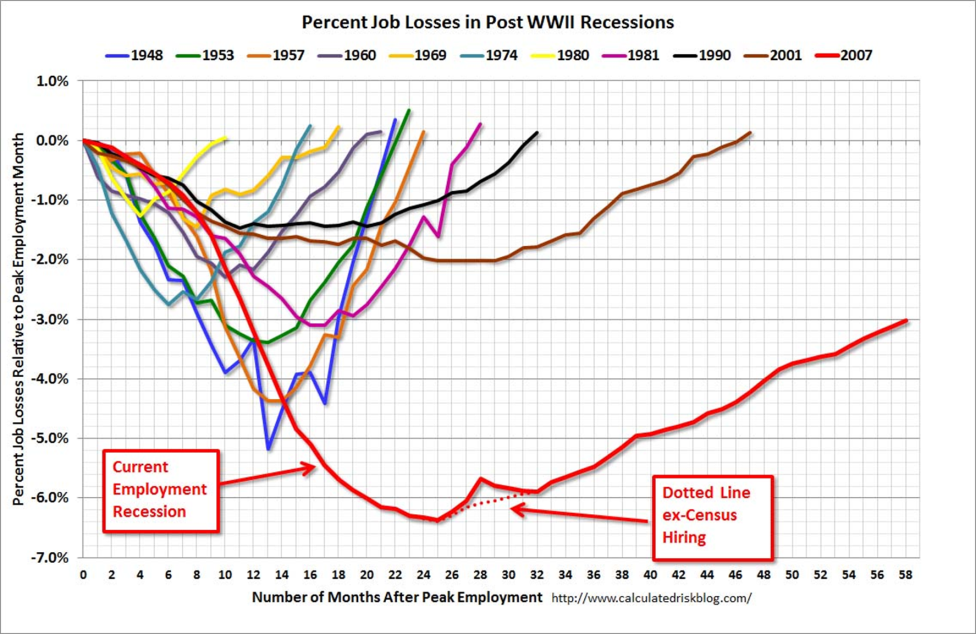

Unemployment According to the U.S. Bureau of Labor Statistics, October 2012 saw 5 million workers be unemployed for 26 weeks or more. Though this is generally trending downwards, the number of unemployed people remains very high. As an integral component to consumer confidence, unemployment rates must be reduced in a drastic manner to boost confidence. (This discussion on unemployment is by no means exhaustive, and will be analyzed in greater detail in the following blog post.)

According to the U.S. Bureau of Labor Statistics, October 2012 saw 5 million workers be unemployed for 26 weeks or more. Though this is generally trending downwards, the number of unemployed people remains very high. As an integral component to consumer confidence, unemployment rates must be reduced in a drastic manner to boost confidence. (This discussion on unemployment is by no means exhaustive, and will be analyzed in greater detail in the following blog post.)

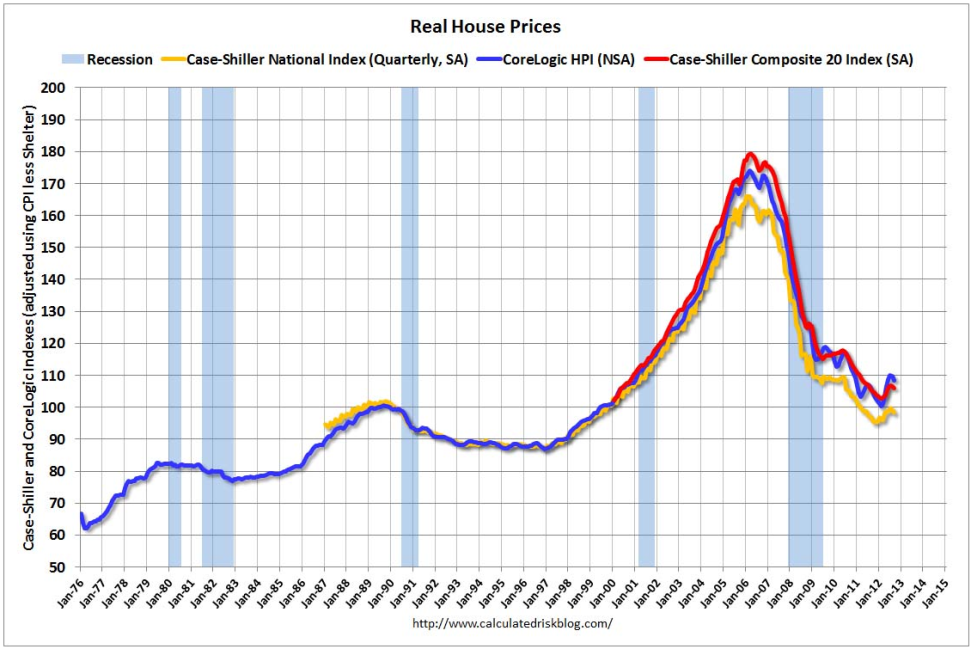

Housing Market  U.S. home prices, another substantial piece of the consumer confidence puzzle, tell a similar story. Currently, U.S. home prices are 30.9% below their peak 2007 values and, adjusting for inflation, home values have reverted back to the levels of 1999-2001. While this too may seem as a relatively bleak depiction of the housing market, it is important to remember that these indicators are trending in a positive direction in light of the damage done by the great recession.

U.S. home prices, another substantial piece of the consumer confidence puzzle, tell a similar story. Currently, U.S. home prices are 30.9% below their peak 2007 values and, adjusting for inflation, home values have reverted back to the levels of 1999-2001. While this too may seem as a relatively bleak depiction of the housing market, it is important to remember that these indicators are trending in a positive direction in light of the damage done by the great recession.

Image from calculatedriskblog.com

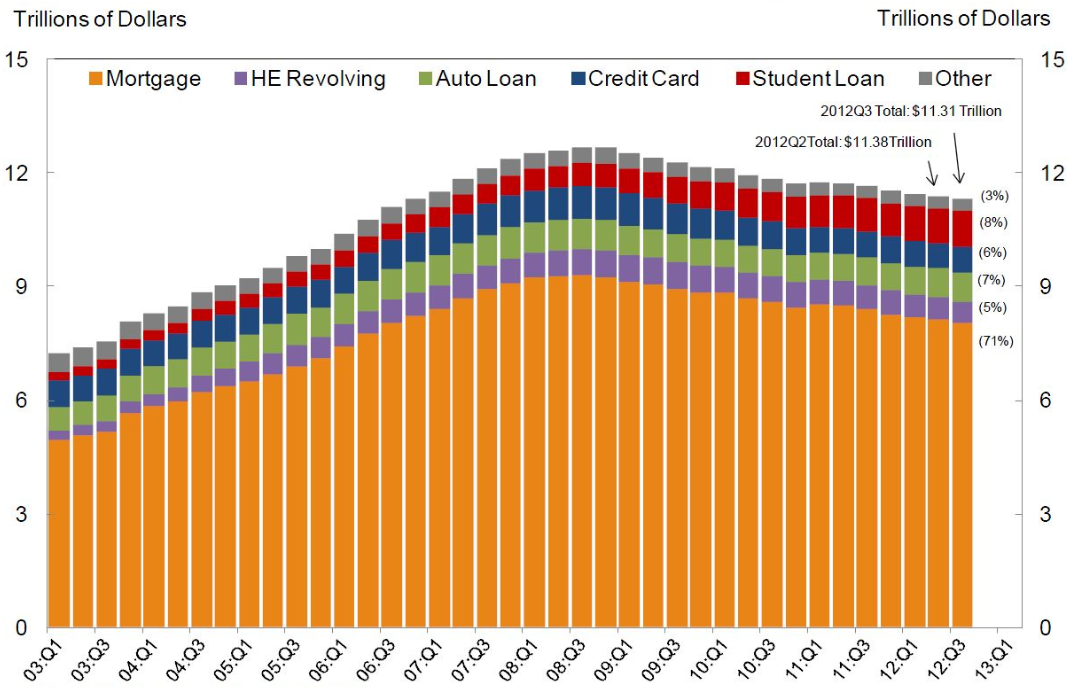

Consumer Debt Consumer debt has continued to trend downward since mid-2008 but student loan debt has continued to increase. Despite the growing student debt, the overall consumer debt is trending downwards. This downward trend represents a positive indicator for overall consumer confidence.

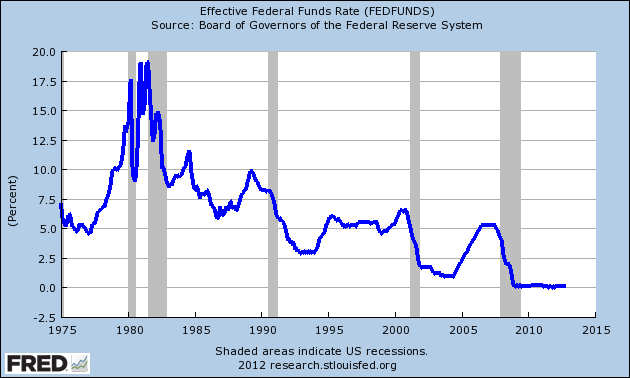

Monetary Policy The U.S. Federal Reserve monetary policy has also had a significant impact upon total economic output. While the Federal Reserve does hold the tools to manipulate the U.S. economy the fastest and in the most direct manner, their ultimate goal remains to provide economic stimulus but not so much that high inflation becomes a problem. Due to the monetary policy, inflation is currently running near its 2% target growth. The Federal Reserve both has indicated that they intend to keep the target range for the federal funds rate, the interest rate at which banks lend their excess balances to other banks overnight, at 0 to 0.25% through at least mid-2015. It is important to note that this has been set to historically low rate to spur economic growth, and will likely never remain at such a level. While commercial banks do continue to deal with problem loans, the overall commercial lending to fuel business growth continues to trend upward.

The U.S. Federal Reserve monetary policy has also had a significant impact upon total economic output. While the Federal Reserve does hold the tools to manipulate the U.S. economy the fastest and in the most direct manner, their ultimate goal remains to provide economic stimulus but not so much that high inflation becomes a problem. Due to the monetary policy, inflation is currently running near its 2% target growth. The Federal Reserve both has indicated that they intend to keep the target range for the federal funds rate, the interest rate at which banks lend their excess balances to other banks overnight, at 0 to 0.25% through at least mid-2015. It is important to note that this has been set to historically low rate to spur economic growth, and will likely never remain at such a level. While commercial banks do continue to deal with problem loans, the overall commercial lending to fuel business growth continues to trend upward.

Conclusion

Given the above mentioned economic indicators, it is abundantly clear that consumer expenditures, subdued inflation, historically low interest rates and a recovering lending environment have all contributed to the growth of consumer confidence as well as a 2% growth (adjusted for inflation) of the U.S. economy as a whole. If the Fed is keeping rates historically low to stimulate continued economic growth and the supply of capital to find business expansion continues to increase, businesses will continue to witness a drastic increase in corporate profits. Though corporate profits started to rebound midway through the previous recession due to expense cutting, revenue growth has allowed for a rapid increase in corporate profits to record high levels. Over time, profitable business owners tend to expand their workforce if they are confident that prospects for revenue growth can be sustained.

Mark Cypert serves as president of Encore Office. He is a senior lecturer for the CCIM Institute with his specialty being in commercial real estate market analysis. For his full biography, click here.