The following is the first of a multi-part lecture series on the U.S. Economy and Commerical Real estate presented by Mark Cypert at the Encore Wealth Breakfast on 12.12.12.

The success of commercial real estate markets is contingent on the success of the larger, general economy. Subsequently, uncertainty with U.S. fiscal policy has negatively impacted business expansion and commercial real estate demand. In this segment, which was presented at the Encore Wealth series on December 12th 2012, I use current economic indicators to determine the future outlook for commercial real estate markets.

To understand why it is that uncertainty within fiscal policy so negatively affects commercial real estate markets, it is important to first understand the commercial real estate demand cycle.

Like links in a chain, when a portion of the commercial real estate demand cycle is negatively affected, the remainder of the cycle is hurt. As we can see, consumer and business confidence are the most impacted by wavering fiscal policy.

To understand what it is that prompts this low level of confidence it is important to first understand the issues currently associated with fiscal policy. With the current U.S. debt burden being so high, having increased to 104.8% from 63.8% as of 2007, the Budget Control Act of 2011 was instituted to minimize high federal debt and all its subsequent ramifications. The act, known as the “fiscal cliff” mandated a combination of automatic tax increases and budget cuts totaling more than $1.2 trillion beginning January, 1st 2013.

While there is bipartisan agreement that a fiscal cliff must be avoided, a bipartisan consensus on the method with which to do so remains highly disputed. Front and center of this political stalemate is the issue of tax increases, which constitute the largest component of the fiscal cliff, totaling approximately $500 billion. If an agreement is not met by December 31st 2012, the Bush tax cuts will expire and all individual marginal tax rates will increase. The lowest bracket is expected to rise from 10% to 15% and the highest from 35% to 39.6%.

In addition to tax increases, the national economy would also see a substantial amount of deficit reduction via sequestration, which refers to the automatic spending reductions totaling $110 billion per year for the next decade. The cuts would be split equally between defense and non-defense programs, though entitlements such as Medicare, Medicaid, and Social Security would generally be spared.

The final, and arguably most critical, component of the fiscal cliff is the debt ceiling limit. Without raising the current debt ceiling, the country faces a potential default that would lead to a significant downgrade of its credit rating and would reverberate across the global capital markets. While Republicans and Democrats have historically been divided on the tax cut versus spending cut debate, the general consensus on Capitol Hill is that if agreement is to be reached, the debt ceiling will be the driving force behind it.

Given the three variables that go into creating the issue of the fiscal cliff, the question of what a post December 31st economy would look like, remains. Currently, the most likely scenario to occur is that Congress will reach an interim compromise agreement that will include an increase in the debt ceiling. The increase would provide time for the parties to negotiate a more comprehensive and long-term fix for 2013. Additionally, a one year extension of the Bush tax cuts limited to income below $200,000 for single filers and $250,000 for married filers is likely to be passed. While it is clear that the accord is a stopgap measure for a much larger and convoluted financial problem, it will nonetheless have some very large and immediate consequences. Those within the highest income brackets will feel an almost immediate tax increase. On the other hand, individuals benefitting from entitlement programs such as Social Security and Medicare will see reduced benefits including a rising of the benefit age, and a reduction in cost-of-living adjustments.

Going back to the question of what this means for commercial real estate markets, it is clear that changes in fiscal policy will subsequently result in changes in the CRE market. Of a few things, we are certain. For one, we are currently witnessing the lowest tax rates of the foreseeable future. Regardless of the outcome of current negotiations, higher taxes are on their way. Real estate investments will continue to be an effective income tax shelter via mortgage interest deductions, cost recovery (depreciation) etc. In sum, businesses and investors will have to endure at least another six months of fiscal uncertainty.

This concludes the first installment of the U.S. Economy & Commercial Real Estate Markets series. Having covered fiscal policy, the segment to follow will discuss the impact of fiscal uncertainty upon consumers.

Mark Cypert serves as president of Encore Office. He is a senior lecturer for the CCIM Institute with his specialty being in commercial real estate market analysis. For his full biography, click here.

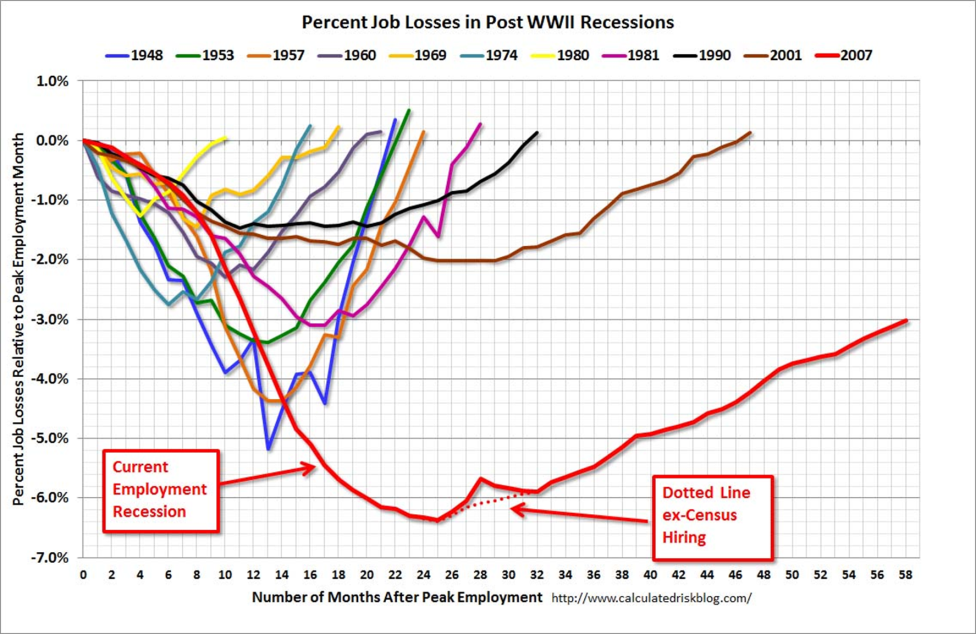

According to the U.S. Bureau of Labor Statistics, October 2012 saw 5 million workers be unemployed for 26 weeks or more. Though this is generally trending downwards, the number of unemployed people remains very high. As an integral component to consumer confidence, unemployment rates must be reduced in a drastic manner to boost confidence. (This discussion on unemployment is by no means exhaustive, and will be analyzed in greater detail in the following blog post.)

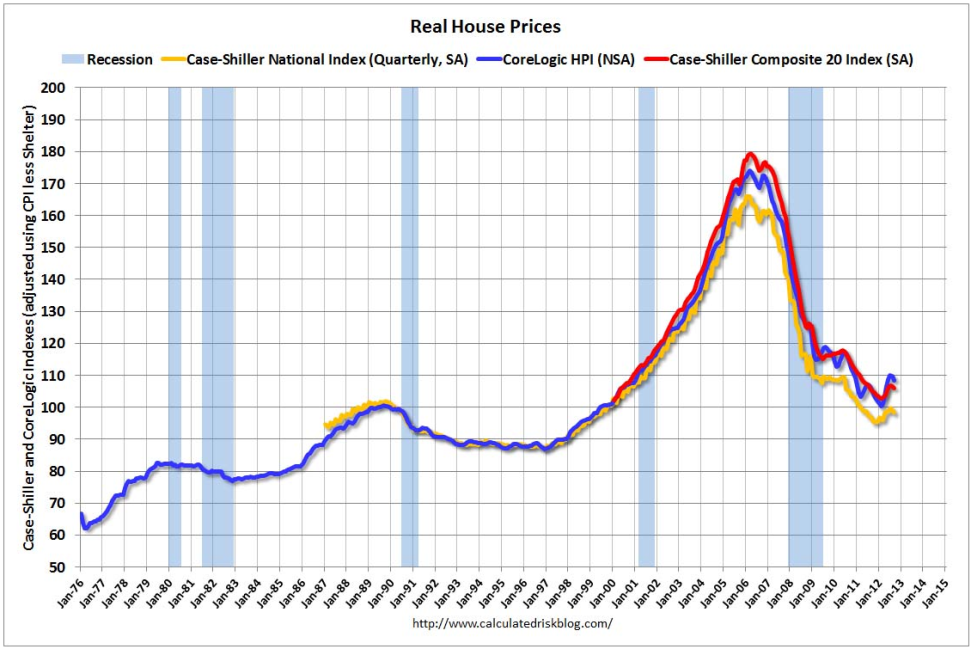

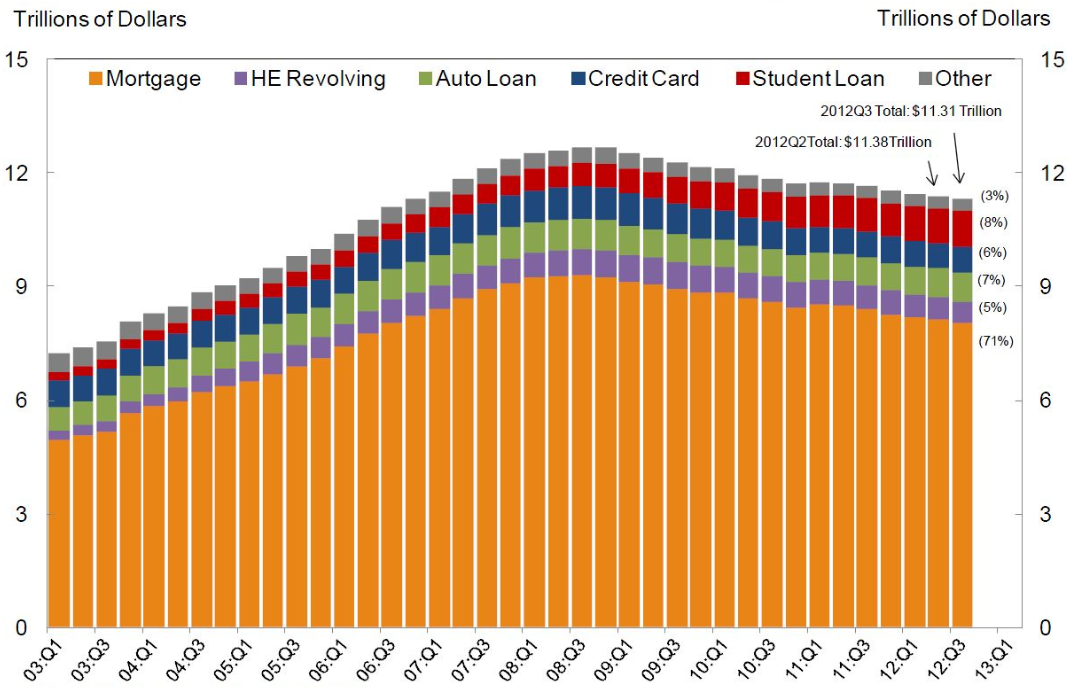

According to the U.S. Bureau of Labor Statistics, October 2012 saw 5 million workers be unemployed for 26 weeks or more. Though this is generally trending downwards, the number of unemployed people remains very high. As an integral component to consumer confidence, unemployment rates must be reduced in a drastic manner to boost confidence. (This discussion on unemployment is by no means exhaustive, and will be analyzed in greater detail in the following blog post.) U.S. home prices, another substantial piece of the consumer confidence puzzle, tell a similar story. Currently, U.S. home prices are 30.9% below their peak 2007 values and, adjusting for inflation, home values have reverted back to the levels of 1999-2001. While this too may seem as a relatively bleak depiction of the housing market, it is important to remember that these indicators are trending in a positive direction in light of the damage done by the great recession.

U.S. home prices, another substantial piece of the consumer confidence puzzle, tell a similar story. Currently, U.S. home prices are 30.9% below their peak 2007 values and, adjusting for inflation, home values have reverted back to the levels of 1999-2001. While this too may seem as a relatively bleak depiction of the housing market, it is important to remember that these indicators are trending in a positive direction in light of the damage done by the great recession.

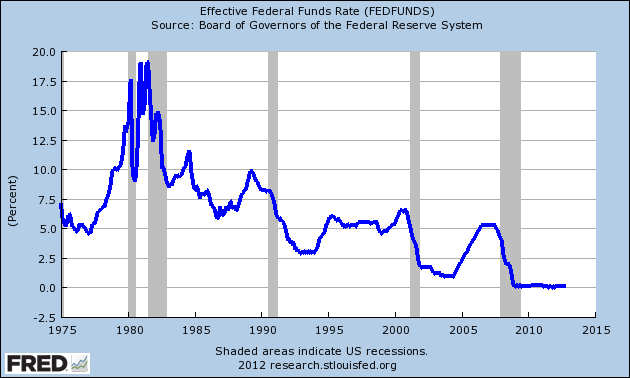

The U.S. Federal Reserve monetary policy has also had a significant impact upon total economic output. While the Federal Reserve does hold the tools to manipulate the U.S. economy the fastest and in the most direct manner, their ultimate goal remains to provide economic stimulus but not so much that high inflation becomes a problem. Due to the monetary policy, inflation is currently running near its 2% target growth. The Federal Reserve both has indicated that they intend to keep the target range for the federal funds rate, the interest rate at which banks lend their excess balances to other banks overnight, at 0 to 0.25% through at least mid-2015. It is important to note that this has been set to historically low rate to spur economic growth, and will likely never remain at such a level. While commercial banks do continue to deal with problem loans, the overall commercial lending to fuel business growth continues to trend upward.

The U.S. Federal Reserve monetary policy has also had a significant impact upon total economic output. While the Federal Reserve does hold the tools to manipulate the U.S. economy the fastest and in the most direct manner, their ultimate goal remains to provide economic stimulus but not so much that high inflation becomes a problem. Due to the monetary policy, inflation is currently running near its 2% target growth. The Federal Reserve both has indicated that they intend to keep the target range for the federal funds rate, the interest rate at which banks lend their excess balances to other banks overnight, at 0 to 0.25% through at least mid-2015. It is important to note that this has been set to historically low rate to spur economic growth, and will likely never remain at such a level. While commercial banks do continue to deal with problem loans, the overall commercial lending to fuel business growth continues to trend upward.

Launched in the summer of 2010, Sterling’s Happy Hour Sale promotion was purposed to reassure travelers and combat cancellations in the wake of the Gulf of Mexico Oil Spill. The weekly email campaign distributed exclusive savings to regional subscribers each Friday afternoon, with time-sensitive offers available at a select Sterling property located along Panama City Beach, Scenic 30-A and in Destin. Propelled by weekly Gulf updates and Sterling’s ‘100% Clean Beach’ guarantee, the Happy Hour Sale campaign generated more than 2,600 phone inquiries and 300 reservations – generating a total $212,000 in revenue.

Launched in the summer of 2010, Sterling’s Happy Hour Sale promotion was purposed to reassure travelers and combat cancellations in the wake of the Gulf of Mexico Oil Spill. The weekly email campaign distributed exclusive savings to regional subscribers each Friday afternoon, with time-sensitive offers available at a select Sterling property located along Panama City Beach, Scenic 30-A and in Destin. Propelled by weekly Gulf updates and Sterling’s ‘100% Clean Beach’ guarantee, the Happy Hour Sale campaign generated more than 2,600 phone inquiries and 300 reservations – generating a total $212,000 in revenue.