Case Study | Hotel Portfolio Sale

$393 mm Acquisition & Sale of 35 Hotel Portfolio – 13 States

- Encore partnered with an institutional investor to purchase 35 hotels, focused on Marriott and Hilton brands

- The institutional investor committed $85 mm in a programmatic joint venture to further expand Encore’s hospitality portfolio

- Over a 24 month period from 2005 to 2007, Encore utilized $55 mm to re-capitalize and acquire a total of 35 hotels (3,840 guest rooms) in 13 states

- 33 hotels were affiliated with either Marriott or Hilton, two of the most desired industry brands

- After evaluating asset and capital market conditions in 2007, Encore decided to cease new purchases and package/sell the portfolio for a total of $393 mm

- A national Institutional buyer bought 29 of the hotels for $315 mm, while six hotels were sold separately to other buyers for $78 mm

Note: Each of the properties in the portfolio were acquired at different points in time for an average hold period of 3.7 years, therefore Encore does not disclose a specific time period for IRR calculations when presenting portfolio case studies

(1) Loan-to-value calculated by dividing total debt by total capitalization

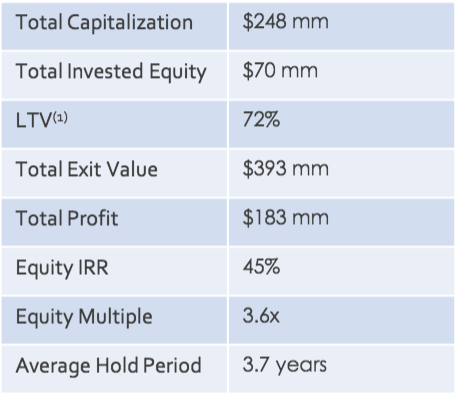

Financial Highlights