The following post is an extension of the discussion held at the January, 15th 2013 Encore Wealth seminar. The lecture, titled “Impact of Decisions in Washington on Small to Medium Sized Businesses as it Relates to Taxation Issues in the Coming Year”, was presented by Tom Montgomery of Montgomery Coscia Greilich, LLP.

Our three previous posts, covering the American Taxpayer Relief Act of 2012 and the newest “Obamacare” taxes have sought to explain the larger picture of the American tax climate. Today, we will take this larger discussion of taxation and examine it in the context of corporate taxation, specifically the impact corporate taxation reform would have on the larger economic climate. While the possibilities of reform are endless, we will be examining two in particular – proposed cuts in corporate income taxes, and proposed tax holidays for repatriation of foreign earnings.

Corporate Income Tax Rate

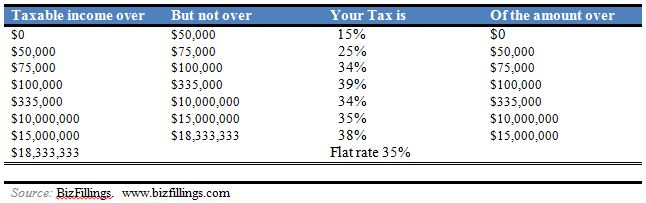

As of right now, corporate income tax rates are as follows:

Income Tax Rate

As the table above indicates, the United States currently has some of the highest corporate tax rates in the world. The double tax system the federal government currently abides by, a system that taxes income at the corporate level, distributes the income, and taxes it again despite having never generated a second layer of income, has been highly criticized as being deeply reactionary to spurring U.S. competitiveness in the global economy. Unlike most countries that offer a full subsidy (to the extent that income is taxed only once), the current American system has pushed people into corporations and at the same time given them a disincentive to distribute income from corporations by double taxing them.

With a strong bipartisan backing, both parties have proposed cuts from the current corporate tax rate of 35 or 34 percent down to 24, 25, or 28 percent. If implemented, this tax reduction will not only incentivize American companies to stay in the U.S., but would inevitably prompt foreign entities to conduct more business in the United States.

Repatriation Tax Holiday

In addition to the above reduction in corporate income taxes, proponents of corporate tax reform have pushed for the creation of repatriation tax holidays. Such holidays would drastically cut the taxation rate, often for a short period of time (generally one year), and subsequently prompt businesses who have amassed profits outside the U.S. to bring the money back into the country. With the top 90 corporations holding 1.8 trillion dollars of cash overseas, a repatriation tax holiday would encourage said companies to bring the money back and potentially reinvest it back into the U.S. economy. As was the case with the repatriation tax holiday passed in 2004, the tax holiday would reduce the tax rate around 85 percent of the normal rate of 35 percent. Learning from the mistakes America made nine years prior, an effective repatriation tax holiday must not only provide a lower tax rate, but ensure that the funds transferred are used in a fiscally responsible manner that promotes direct reinvested into the U.S. economy.

View this and all other topics covered by Mr. Montgomery here: